## PDF 2016 Cfa Level 2 Schweser Notes 3 Practice Exams With Answers Quicksheet ## Uploaded By Alexander Pushkin, 2016 cfa level 2 schweser notes 3 practice exams with answers quicksheet sep 30 2020 posted by harold robbins ltd text id 772a3c44 online pdf ebook epub library epub library 11 2020 posted by frederic dard. The CFA ® Program includes the foundational knowledge that firms expect as well as the critical advanced investment analysis and portfolio management skills that are needed in investment management today. We update our curriculum regularly, so it reflects modern financial practices. Our candidates can bring what they’ve learned through the CFA Program to real-world scenarios.

Just like Level I, CFA Institute’s curriculum for Level II can reach nearly 3,000 pages, but be warned: these materials are much more difficult to understand. Level II is the essential next-step for achieving greatness in your financial career. Without Level II, you cannot move on to Level III or become an official CFA Charter holder.

Last Updated: July 3, 2020

The table shows the weights of all level 2 CFA exam topics for your Dec 2020 exam:

| Level 2 Topics | Minimum Topic Weight | Maximum Topic Weight |

|---|---|---|

| Ethics | 10% | 15% |

| Quantitative Methods | 5% | 10% |

| Economics | 5% | 10% |

| Financial Reporting and Analysis | 10% | 15% |

| Corporate Finance | 5% | 10% |

| Equity Investments | 10% | 15% |

| Fixed Income Investments | 10% | 15% |

| Derivative Investments | 5% | 10% |

| Alternative Investments | 5% | 10% |

| Portfolio Management | 10% | 15% |

As you can see, among the most important topics are:

- Equity Investments (EI),

- Financial Reporting and Analysis (FRA),

- Fixed Income (FI), and

- Ethical and Professional Standards (Eth).

You should devote even up to 60% of your study time to these four topics.

Also – among the topics with the highest number of questions in the exam – you can expect to find Porfolio Management (PM).

Number of Questions and Item Sets for Level 2 CFA Exam Topics

Level 2 exam questions are arranged into item sets. What it means is that the total of 120 exam questions (60 questions per each exam session) is divided into smaller groups of multiple-choice questions topped by vignettes (short cases forming the basis for the multiple-choice questions).

There used to be 20 item sets altogether (10 per exam session), where each item set included 6 multiple-choice questions. However, as of June 2019 level 2 CFA exam, CFA Institute decided to have item sets with a varying number of questions (this may be a way to eliminate item sets with questions from various topics, which indeed happened in the past). In June 2019 exam, there were 21 item sets: 18 with 6 and 3 with 4 multiple-choice questions, which probably looked as follows:

| MIN no. of questions | MAX no. of questions | Predicted no. of questions | Predicted no. of item sets | |

|---|---|---|---|---|

| Ethics | 12 | 18 | 12 (6+6) | 2 item sets |

| Quantitative Methods | 6 | 12 | 10 (6+4) | 2 item sets |

| Economics | 6 | 12 | 6 | 1 item set |

| Financial Reporting and Analysis | 12 | 18 | 18 (6+6+6) | 3 item sets |

| Corporate Finance | 6 | 12 | 10 (6+4) | 2 item sets |

| Equity Investments | 12 | 18 | 18 (6+6+6) | 3 item sets |

| Fixed Income Investments | 12 | 18 | 16 (6+6+4) | 3 item sets |

| Derivative Investments | 6 | 12 | 12 (6+6) | 2 item sets |

| Alternative Investments | 6 | 12 | 6 | 1 item set |

| Portfolio Management | 12 | 18 | 12 (6+6) | 2 item sets |

| SUM | 84 | 150 | 120 | 21 |

In your Dec 2020 level 2 exam, you can expect from 10 to 15 vignettes supporting 60 multiple-choice questions per exam session (i.e. 20-30 vignettes altogether supporting 120 multiple-choice questions). So, in fact it gets impossible to predict what your exam might look like. You may end up taking a regular test of 10 item sets per exam session, each with 6 multiple-choice questions. But even more likely you may expect an irregular test where the number of item sets varies from session to session and different item sets have different number of multiple-choice questions. Cheer up, though. To ensure that both sessions are fair, there's one thing that's unchangeable, namely the total of 60 multiple-choice questions per exam session.

Dec 2020 Level 2 CFA Exam Weights

Level 2 CFA exam topic weights given in ranges aren’t very helpful, are they? Whether presented as a percentage or as the number of questions, you cannot tell exactly how many questions each topic gets in your exam.

If we wanted to present current level 2 topic weights as single (average) values, we could use the arithmetic mean. This is what we'd get:

However, this measure is far from ideal. It doesn’t sum up to 100% because of the disproportion between the minimum and maximum topic weight. If you add the numbers in the first column of the table above, you’ll get 84 questions. If you add the numbers in the second column, you’ll get 150 questions. In the level 2 exam, there are 120 questions – so the arithmetic means all summed up will be slightly lower than 100% (because the sum of minimum no. of questions is a bit below 90). Sorry. Guess it’s not that easy to arrive at a plausible question distribution among topics in the CFA exam.

Still, in the third and fourth column of the table above, we give you our prediction. It was made for June 2019 level 2 exam but we believe it can give you some food for thought as regards your Dec 2020 level 2 exam format. That's why we continue to have it here so that you can read it. It assumes the new item set system, including the 1 item set = 1 topic attempt, and is based on both the new and the old level 2 topic weights. See for details below.

Before June 2019, level 2 topic weights were different with the highest values of 15-25% for Equity. Other level 2 topics weights were as follows: FRA (15-20%), FI (10-20%), Ethics (10-15%), CF (5-15%), DI (5-15%), QM (5-10%), PM (5-10%), ECO (5-10%), and AI (5-10%).

Although the weights are changed now, the difficulty of the topics stays pretty much the same. This allows us to arrive at the number of item sets possible also in your Dec 2020 level 2 exam. Before we explain the numbers proposed, we analyze two rather extreme scenarios:

Scenario 1:

Take the 4 most important topics first and assume each will get as many as 18 questions in your exam. You already end up with 72 questions. Now add 18 more questions for Portfolio Management – that’s already 90 questions. You are left with 30 questions, which leaves us with the average of 6 questions for each of the 5 remaining topics (and 6 is the minimum no. of questions for each of these topics).

Scenario 2:

Now consider the other extreme scenario where each of the 4 most important topics is given only 12 questions, which totals up to 48 questions. This means you are left with 72 questions to distribute among the other 6 topics, i.e. 12 questions per topic on average. This is how you end up with equal topic weights for all level 2 CFA exam topics, which is highly undesirable.

Neither of these two extreme scenarios is what CFA Institute surely aims at. Of course, the number of questions per each topic may vary from exam to exam. But we think our estimation is good enough to serve as a credible benchmark that finally translates the opaque level 2 topic weights into a more transparent system.

Scenario 3:

Here's our educated guess that worked just fine for June 2019 level 2 exam:

- 18 Equity questions (6+6+6=3 item sets) – it used to be up to 30 questions (5 item sets) and no readings have been taken away from the curriculum

- 18 FRA questions (6+6+6=3 item sets) – it used to be up to 24 questions (4 item sets) and a new reading has been added to the curriculum

- 16 Fixed Income questions (6+6+4=3 item sets) – it used to be up to 24 questions (4 item sets) and no readings have been taken away from the level 2 curriculum

- 12 Ethics questions (6+6=2 item sets) – CFA Institute promotes ethics but you are tested on the same Code and Standards for the second time (and 12 questions is already quite a lot)

- 12 Derivatives questions (6+6=2 item sets) – it used to be up to 18 questions (3 item sets) and no readings have been taken away from the curriculum

- 12 Portfolio Management questions (6+6=2 item sets) – it used to be up to 12 questions (2 item sets), now it’s up to 18 (but the readings stay the same)

- 10 Quantitative Methods questions (6+4=2 item sets) – a new reading has been added to the curriculum + 1 of the readings has been extended by the subject of machine learning

- 10 Corporate Finance questions (6+4=2 item sets) – we go for 10 questions here ‘cos we believe that all the above topics are indeed more important and this topic is most likely to be left with just 10

- 6 Alternatives questions (1 item set) – as above (plus note we’re slowly reaching the total of 120 questions and 21 item sets, so 1 item set with 6 questions is what it is)

- 6 Economics questions (1 item set) – as above (plus it’s now 120 questions/21 item sets total )

CFA Exam: Difficulty of Level 2 Topics

As we’ve already said, although the weights changed, the difficulty of the topics stays pretty much the same. Of course, topic difficulty is a subjective criterion but you’ll surely agree that EI with its current weight of 10-15% and still more than 500 pages in your CFA Program curriculum seems both important and difficult. In our free CFA exam study planner, you get lots of extra time scheduled to study Equity and other important topics, i.e. Ethics, FRA, and Fixed Income.

While creating your personalized CFA exam study schedule, you can choose the topic sequence you like:

- Soleadea topic sequence based on topic length, difficulty, and importance (highly recommended ):

ETH, EI, FI, DI, FRA, CF, QM, PM, ECO, AI, ETH, - CFA Program curriculum topic sequence: ETH, QM, ECO, FRA, CF, EI, FI, DI, AI, PM, or

- CFA Program curriculum topic sequence but with Ethics at the end: QM, ECO, FRA, CF, EI, FI, DI, AI, PM, ETH.

You're just 2 clicks away:

It All Starts With Your

CFA Exam Study Plan

Get your topic readings assigned to consecutive study weeks!

- Log in or register to post comments

Level I books, study guides and notes for quick review of textbooks in CFA exam prep

Passing Level I is the first step towards becoming an officiated CFA Charterholder. Do not treat it lightly!

CFA Level I material

It is certainly true that Level I is the easiest exam relative to the exam levels II and III. The key word here is relative.

Cfa Level 2 Quicksheet Pdf File

Level I preparation is an arduous task in its own right, and it being the easier of the three should not convince you it will be a cakewalk!

Why you need CFA study guide for Chartered Financial Analyst study?

Consider the scope of the study material - level I: the fundamental ethics and professional standards, as well as a laundry list of financial topics, like equity, economics, portfolio management and so, so much more.

The official CFA curriculum clocks in at approximately 3000 pages of material, so much you could study it for a year and still not master it.

You only have a limited amount of time for Level I exam preparation, so every second counts.

Preparation with FinQuiz CFA exam Level 1 study material can save your time!

While you will need a full and total reading of all official level I textbooks to pass, it is practically impossible to read through textbook twice, let alone read through it enough to absorb all the key concepts.

To excel, you need supplementary materials and study program to guide your focus and efforts for level I.

This is why FinQuiz is such a fantastic tool for serious students. We supplement every LOS of official curriculum with helpful notes, formula sheets, summaries and other CFA study material to ensure a comprehensive understanding of everything you need to know.

Consider just some of what we offer in our Level I study material and download free CFA study material PDF by clicking here.

Cfa Level 2 Quicksheet Pdf

Question Bank

The Level I exams may be easier, but they are certainly not easy. Official CFA exams are more than just a list of questions: there is specific timing, style and procedure you will have to undergo when taking your exam. That is why we constructed our mock materials to accurately mimic the flow and length of the official exam, so you are fully mentally and emotionally prepared for the actual test. Sitting down to a heaping bowl of exam questions is probably not your favorite dish, but it will get you closer to that charter. We are here to help. Want to learn more? Read: How to remember 90% of what you studied for CFA exam?

Summaries

3000 pages is a lot of material to study, and you only have so much time. To properly study for the CFA, you need to condense the less critical aspects so you can focus on what truly matters. Our summaries are constructed by experienced CFA test-takers and administrators, so that our summations are comprehensive on what will be tested to the minute detail, and relatively light on the less important materials.

Chapter notes

Our notes are the best on the market, bar none. Designed to supplement, not replace, your Level I materials, these notes will reinforce what you need to know so you are more fully prepared for the exam. You would not need extra study guides from anyone else: you will find our notes fully cover it all.

Mock exams

Cfa Level 2 Quicksheet Pdf Download

The Level I exams may be easier, but they are certainly not easy. Official CFA exams are more than just a list of questions: there is specific timing, style and procedure you will have to undergo when taking your exam. That is why we constructed our CFA Level 1 mock exam to accurately mimic the flow and length of the official exam, so you are fully mentally and emotionally prepared for the actual test.

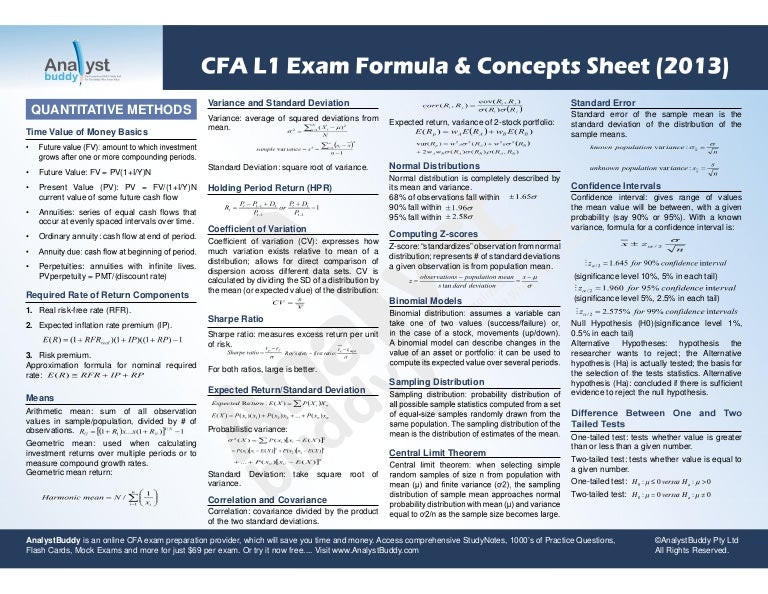

Formula sheet

Cfa Level 2 Quicksheet Pdf Converter

Level I is notorious for the diverse and complicated formulas you will need to memorize perfectly. Do not despair just yet: our study materials including comprehensive formula sheets, with tools and tricks towards memorizing each and every individual formula. You will find with FinQuiz formula sheet, memorization will be a breeze!